* Currently: 33 states require an annual flat registration fee for electric vehicles (with other states in the process of creating them).

* This is harmful as it punishes drivers who travel fewer miles and who drive smaller more efficient vehicles.

* It can result in ridiculous discrepancies (someone who drives a Chevy Bolt 5,000 miles a year pays the same as someone who drive a Hummer EV 40,000 miles a year. Someone who drives 15,000 miles a year in Texas with an EV pays the same as someone driving a 15mpg gas vehicle the same distance.

* I am NOT saying that EV’s should pay no road tax. The solution is one that considers either miles traveled, power consumed, or a combination. For example: If we took Annual mileage/(mpge/3)\*(state gas tax), then a 70mpge ford F150 lightning would pay about the same gas tax as a 23mpg 2.7 Liter V6 gas version. A 100mpge vehicle would pay the same tax as a 33mpg gas vehicle, etc. (The exact numbers could be adjusted, but this is just an example of something that would be significantly better than the one size fits all flat fee)

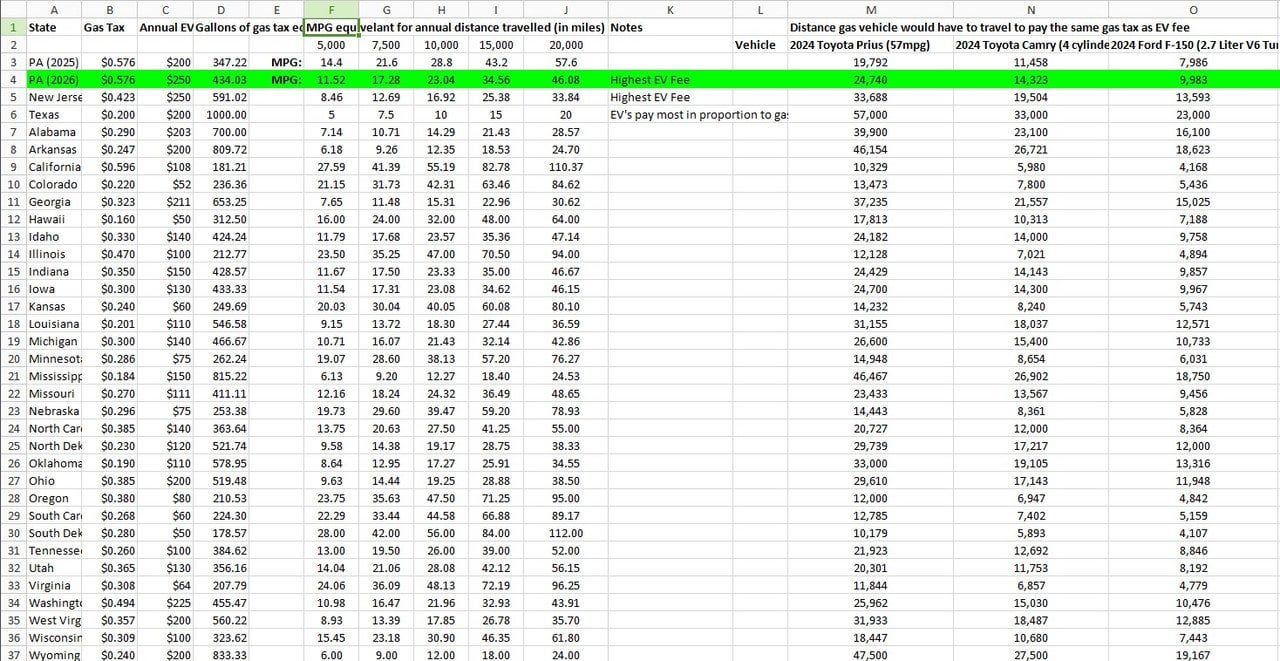

If anyone is interested, I actually made a spread sheet that shows the gas tax and EV registration fees (for all states that have them, +PA with their proposed future fees). I include mpg equivalent you’re paying gas tax to in that state based on how far you drive in a year, and include some example gas vehicles showing how many miles they’d have to travel before the gas tax they pay is equal to the EV registration fee (for example, in Texas a 2024 prius would have to go 57,000 miles in a year to pay gas tax equal to the EV registration fee)

Note: the spreadsheet is still a work in progress and I have not yet included any hybrid fees (as those are often different, but I plan to include this in the future).

Here is a screenshot of the spreadsheet in progress:

[https://i.postimg.cc/5tTXZfxq/spreadsheet-screenshot.jpg](https://i.postimg.cc/5tTXZfxq/spreadsheet-screenshot.jpg)

Notes: Most of it is alphabetical with 3 exceptions. New Jersey at the top has the highest set EV registration fee ($250). Texas has the highest discrepancy where EV’s pay the most in proportion to gas vehicles compared to any other state) and Pennsylvania, which has no registration fee in 2024, but voted to pass one if the governor signs it into law (starting at $200, then moving to $250, then is allowed to increase every year 2027 onwards) so they’ll be tied for the highest EV registration fee in 2026. Again, I haven’t included hybrids yet, and am open to suggestions.

by 0ne_Wheel_Man

17 Comments

Annual miles traveled * GVWR would be the fairest and possible to track.

Look at what NZ is doing – you pay per distance traveled. The rate is ~$80 NZD per 1000 km. Diesels are on the same scheme. Regular petrol cars however are not. The government is saying that it’s coming “soon” but no timeline given. PHEVs are a bit of an odd duck out and pay $37 per 1000km (+ fuel tax). The calculation is based roughly getting parity between an EV and car that does 10L/100km (~23mpg) – not spectacularly accurate, but not too unfair.

Hybrids (non-plug variety) make out like bandits in the current climate. Before my Model 3 I had a Prius and my cost per km is basically the same of around 11c/km. In the Tesla – I am paying 3c/km in electricity and 8c/km in road tax. The Prius was the reverse of that – 8c in actual fuel cost and 3c was the tax portion. So how the fuck does that make any sense?

It’s only going to be fair when EVERYONE is on the same system. Also – who’s leg do I need to hump to pay $200/yr. Currently paying $800 NZD (~$500 USD) to do 10k km (~6200 mi). So yay me!

things can change.

**Caltrans pilot program tests replacing gas tax with charging per mile driven**

[https://abc7.com/post/caltrans-to-test-california-road-charge-for-miles-driven-instead-of-gas-tax/14828291/](https://abc7.com/post/caltrans-to-test-california-road-charge-for-miles-driven-instead-of-gas-tax/14828291/)

>someone who drives a Chevy Bolt 5,000 miles a year pays the same as someone who drive a Hummer EV 40,000 miles a year

your insurance company assumes you drive X miles per year whether or not you actually do.

maybe insurance should charge by mile too.

Tough to come up with a one size fits all. You’ll have those outliers that will skew the fairness. Your last point would make sense but you need to have a truthful reporting mechanism. People would either need to tell the truth on the miles driven per year, or some sort of tracking device reporting to the state. My state NJ doesn’t have EV inspections so it can’t be done there. The $250 starts this year and I think caps at $290.

But I’m ahead of the game by a good amount as I didn’t pay any sales tax (nearly $4k savings) on my purchase 4 yrs ago so maybe they’re making up for it and future proofing it while they can. Heck, it took them 30 years to boost the state gas tax. Since I do 15k to 20k per year it seems about right to me. But I’m an civil engineer in the transportation field go figure.

Probably not a popular opinion, but I have driven an ev in Texas for 12 years. I think the $200 a year seems like a lot, but is likely fair. Charging per mile would be better but would come with overhead that would increase the overall cost.

You also aren’t taking into account the national gas tax revenue that will need to be replaced if everyone goes electric.

Working as intended. High upfront costs are the biggest deterrant for the sale of basic EVs. Nobody makes money off of cheap EVs.

One of the reasons I’ve just about decided to stick with an ICE as my next vehicle instead of originally going with an EV. I only drive about 3,000 miles a year. The higher EV starting prices and registration costs would eat up any savings I’d get from not going to the pump.

I’m the Bolt driver who only drives 6K miles a year. I switched from a hybrid. My fuel tax bill is a lot higher.

The gasoline tax is federal and state. The additional registration fee is only state. What does this do to calculations.

I absolutely agree. I bought an EV primarily to cut down on maintenance costs, and typically only drive 20 miles per week, as I’m disabled and unemployed. Rounding up *generously* I drive *maybe* 2000 miles per year. And yet my fuel tax replacement fee assumes I’m driving 2000 miles per *month*. It’s asinine and unfair.

Others propose GVWR, but no passenger vehicle has enough weight to be anything other than a rounding error compared to commercial vehicles, as road maintenance is required based on the 4th square of vehicle weight.

So all we need is a fuel tax, on gas and on electricity to accomplish everything that needs to be done.

I think we have those already, don’t we?

It’s especially crazy to offer state rebates for EVs and then take it back in fees. States have good reasons to support EV adoption and factories. Gas taxes don’t pay for the thousands killed and maimed each year by pollution. Oil companies get more money and more breaks than anyone. And shame on electric companies jacking up rates on consumers, especially those charging at home. Dems can gain votes with EV policies looking towards the future.

Struggling to understand why any light vehicle owner, ICE or EV, should accept **any** substantial road tax. The [Fourth Power Law](https://en.wikipedia.org/wiki/Fourth_power_law) demonstrates that road wear from vehicular traffic scales up not linearly, but exponentially by weight.

If you run the math you soon realize a loaded B-train does more road damage in a single day than two hundred Tesla Model 3s would in an entire year. So if you take $200 out of the EV owner’s pocket you should be proportionally taxing a commercial truck operator something like $19 million proportionate to their effect on our roads.

A great deal more heavy frieght used to move by rail, until industries realized they could run their freight on public roads and pass on the infrastructure costs. I see both EV and fuel taxes as just one more way private enterprise continues to offload its operating costs onto the backs of working taxpayers.

So, what happens when EVs reach the end of their lifespan, or when people replace their cars? Most people will likely time it so that they do not have to pay for those last miles driven. Given that 20 million new vehicles were sold in the United States in 2023, that is a huge revenue loss for road maintenance.

How will you track and enforce this? I have no interest in the government knowing my comings-and-goings, as they would need to in order to track mileage.

You have only included the state fuel tax in your calculations, which skews your numbers. State EV fees are designed to replace both the state and federal fuel taxes. Although it might seem counterintuitive, both the state AND federal fuel taxes actually flow to the state. When someone switches to an EV, that state loses the revenue of BOTH taxes.

Texas published the numbers they used. The EV fee was designed to replace the taxes that would be paid by the average ICE car getting 22.3 MPG and driving the average 11,484 miles per year.

* 11,484 miles / 22.3 MPG = 515 gallons

* 515 gallons * $0.384 fuel tax = $197.76

* $197.76 was rounded to $200 for the fee

All that said, your points are reasonable about the flat tax no longer giving benefit to efficient/low-mile drivers.

These are the same arguments I made to my state representative and senator before they completely ignored me and enacted ridiculous anti-EV registration based fee structure instead. The ironic part was that I still won, as PHEVs pay the lowest rate anyway.